Turbion Capital is not a lender. Funding offers are provided by third-party partners and are subject to underwriting and verification.

Turbion Capital is not a lender. Funding offers are provided by third-party partners and are subject to underwriting and verification.

AdvisorHub is our partner funding platform used to manage your application and communication.

Funding offers are provided by third-party providers and subject to underwriting.

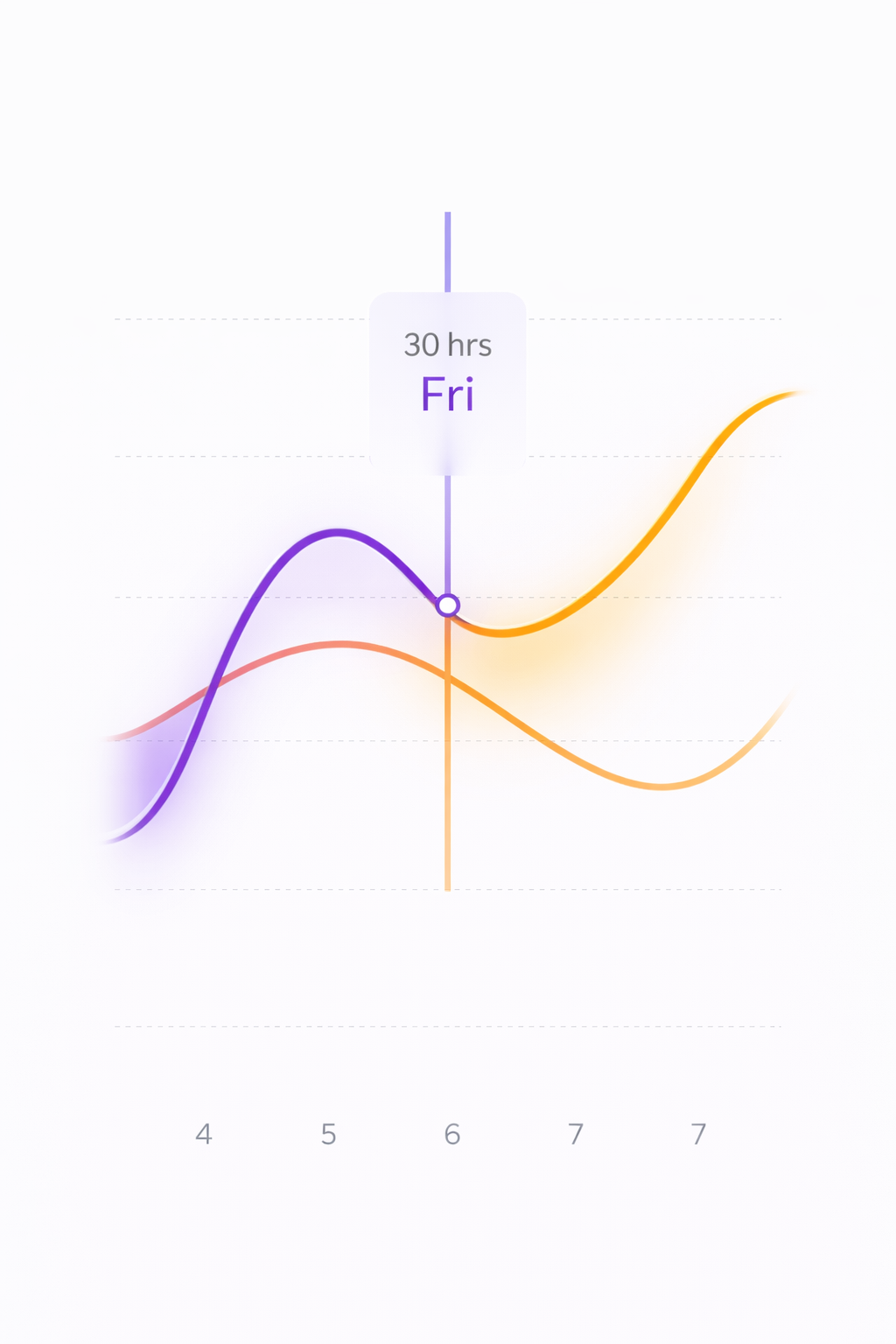

Loan approval times can vary depending on the type of funding method, the completeness of your application, and other factors. Generally, you can expect a decision within 1-5 business days after we receive all necessary documentation. On average 48 hours.

Usually, you’ll need proof of identity, proof of income, and financial statements. Depending on the type of loan, other documentation may be required. Your advisor can discuss this further with you.

Yes. We will walk you through how to properly setup a business, and then begin the business funding process.

Yes, but to secure higher limits and 0% interest terms, you will need to have a solid credit profile, 680+ to start.

Absolutely. We use the latest encryption technology to ensure that all your personal and financial information is safe and secure.

Any amount you qualify for, Results may vary depending on the client profile. Impruvu does not guarantee an exact amount for the total amount funded. In most cases for startup funding, eligible clients receive between $50,000 and $150,000 in their first round of funding and up to $150,000 to $350,000 after additional rounds of funding. The amount of funding obtained is based on personal and business creditworthiness.

Funding eligibility is determined by a number of factors, including your credit score, income, employment status, and the amount of debt you currently have. We useFrom there, we take care of everything. Your job is to stay focused on what you do best—while we build the intelligence to handle the rest.